NMPIP 197: Allocate 14,400 ETH to Rocket Pool Protocol rETH

Note: I’m posting this NMPIP on behalf of @Uisce.eth, who authored this post and is transitioning the previous RFC to a formal NMPIP.

Summary

Members have voted in a pair of Snapshot signalling votes to indicate their support for allocating ETH from the capital pool to liquid staking with the Rocket Pool Protocol.

- Signaling Vote: Should the mutual Stake with Rocket Pool (#1)

- Signaling Vote: Amount of ETH to allocate to Rocket Pool (#2)

Through these signalling votes members have shown a desire to allocate 14,400 ETH—approximately 10% of the Capital Pool—to staking with the Rocket Pool Protocol by exchanging ETH for the rETH liquid staking token. I’m proposing members take action to approve this allocation through an on-chain vote.

Rationale

In the Investment Philosophy Review - 2023 the Nexus Mutual Investment committee has recommended a target of 40% allocation of the mutual’s funds to lower risk investments such as ETH staking.

Staking with the Rocket Pool protocol would increase the mutual’s investment in liquid staked ETH while adding protocol diversity which will limit the risk of exposure to any single staking provider.

Rocket Pool rETH is a suitable choice for investment as:

- It is security conscious; audited, battle tested & has an active bug bounty.

- Has a suitable oracle for monitoring in the Chainlink rETH/WETH oracle.

- rETH can be held directly by the mutual and exchanged easily.

- It has by far the most decentralised node operator set among staking providers.

For further detail & more information you can refer to [RFC]: Staking with Rocket Pool Protocol

Specification

The proposal is to exchange 14,400 ETH for rETH in order to generate an investment return for the mutual based on ETH staking rewards net of Rocket Pool fees.

At the current rETH price of Ξ1.0764, the 14,400 ETH would be equivalent to 13,377 rETH. However, in 12 days, rETH should increase in value and the mutual would be able to trade the 14,400 ETH for 13,362 rETH.

Technical Requirements

If members support this proposal 14400 ETH will be exchanged for the rETH token using the mutual’s CoW Swap integration as follows:

- rETH will be added as an asset to the Capital Pool

- To enable the swap integration to trade rETH to the correct amount, the following parameters will be set for rETH in the pool:

- Minimum asset amount: 13,362

- Maximum asset amount: 13,400

- Chainlink rETH/ETH will be added as an oracle to track the value of rETH

Proposal status

This proposal is open for review and comment from Wednesday (5 July) until the end of day on Tuesday (11 July).

Previously, this proposal was posted as an RFC on the forum, after which it proceeded to a pair of non-binding signaling votes before moving to the current NMPIP stage.

Following the review period, this NMPIP will proceed to an on-chain governance vote on Wednesday (12 July).

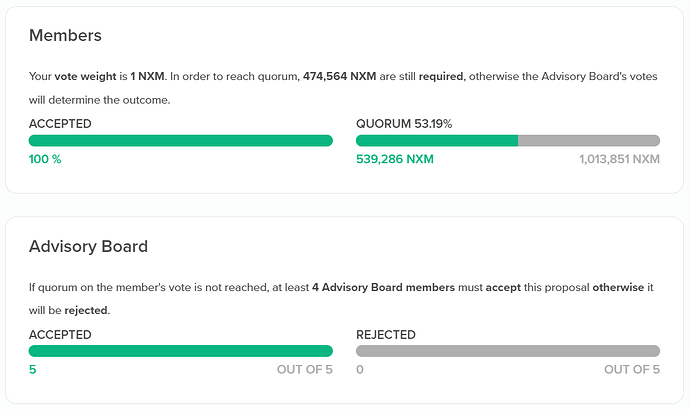

This NMPIP has been transitioned to an on-chain vote, which is open for voting from Wednesday (12 July) until Saturday (15 July).

Outcome of the vote

After the three-day voting period ended, members unanimously voted to stake 14,400 ETH from the Nexus Mutual capital pool with Rocket Pool.

After the 24-hour cool-down period passes, this proposal can be executed. In the coming week, ETH from the capital pool will be staked with Rocket Pool and rETH will be added to the capital pool.

Source: Nexus Mutual UI in Governance tab