Overview

In April 2021, the Operation Wartortle Proposal was posted on the forum. This proposal requested $50,000 in NXM to fund a legal analysis/review of the possible dissolution of the Nexus Mutual Ltd. legal entity and explore a transition to a stateless DAO.

Members approved the Operation Wartortle request for funding with 100% approval (172.6 NXM voting in favor). On 27 July 2021, Hugh provided an update and shared that Norton Rose Fulbright had completed their analysis. Hugh also provided a summary of the risks and indicated further advice was needed on the tax implications of a transition to a stateless DAO.

The mutual secured the services of a premier global law firm to review the tax implications of a transition to a stateless DAO structure. After reviewing the tax advice, the Nexus Foundation has guidance to share with members of the mutual regarding the first step in a transition to a stateless DAO.

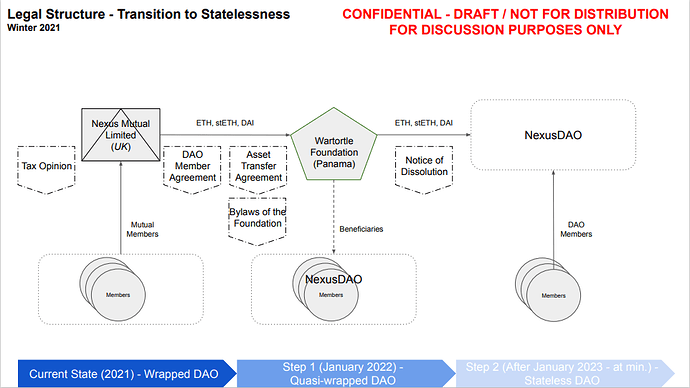

The Path Toward Statelessness

Currently, the mutual’s assets are held by Nexus Mutual Ltd. (i.e., the legal entity), which resides in the UK. The legal entity was set up at launch to establish the mutual as a discretionary mutual fund; because the legal entity was established in the UK, the mutual has had to remain compliant with UK companies law and other UK regulations. The compliance issue that has been the most contentious is the requirement for members to go through KYC/AML to become full members of the mutual.

If the mutual were to begin the transition to a stateless DAO, the first step would be a legal restructuring of the mutual from the Nexus Mutual Ltd. legal entity to another legal entity that would serve as a stepping stone to a stateless structure. After reviewing available options, a legal restructuring to a Panama Private Interest Foundation would provide the best protections for members of the mutual.

If a Panama Private Interest Foundation is created and members were to approve this option, the mutual’s assets (i.e., ETH, stETH, and DAI) would be transferred from Nexus Mutual Ltd. to the Panama Private Interest Foundation (i.e., the “Foundation”). The mutual’s assets would be held in the Foundation for at least one year and one day, after this time, the Foundation could be liquidated and the mutual would become a stateless DAO.

First Step

To begin the process toward a stateless structure, members of the mutual would need to review, approve, and agree to a new membership agreement, which is included below as the DAO Member Agreement. If members were to approve the language in the DAO Member Agreement, they would cease to be members of the Nexus Mutual Ltd. legal entity and become members of the Nexus Mutual DAO. The Nexus Mutual DAO serves as the beneficiary of the assets held by the Foundation. Key provisions of the DAO Membership Agreement are summarised below with a link to the full text of the DAO Membership Agreement at the end of this section’s summary. The suggested first steps do not contemplate the removal of KYC, we suggest members revisit this topic in the future if assets were to be transferred to the Panama Private Interest Foundation.

Members would also need to review and approve the Asset Transfer Agreement and the Bylaws of the Foundation, which would represent the interests of the Nexus Mutual DAO members.

DAO Membership Agreement

Currently, any member has to approve the existing Membership Agreement and submit documents to verify their identity using the mutual’s Know-Your-Customer / Anti-Money-Laundering (KYC/AML) process. By becoming a member, a person agrees to the conditions specified in the Articles of Association and Member Rules. This process is compliant with existing UK legal requirements that members of the Nexus Mutual Ltd. legal entity are subject to.

If members were to agree to the Member Agreement of Nexus Mutual, A Decentralized Autonomous Organization, then they would no longer be members of the Nexus Mutual Ltd. legal entity and each member would become a DAO Member of Nexus Mutual.

The DAO Membership Agreement is included in full at the end of this section, but we will summarize the following key sections:

- Article III: DAO Membership

- Section III.5 Liability

- Article IV: Binding Effect of the Designated Smart Contract

- IV.2 Exception Handling

- Article V: Representations and Warranties

Article III: DAO Membership

This section defines what constitutes membership in the mutual, the way in which membership is tokenized, the rights of DAO members, the agency members have and do not have within the mutual, and the liability protections members agree to as part of the DAO Membership Agreement.

To be a member, one must register an address with the Designated Smart Contract and interact with the mutual using the public key (i.e., public wallet address) associated with their membership address. To be a member, one does not need to hold tokens of the DAO but only to register an address with the Designated Smart Contract.

Each DAO Member is allocated one vote plus any DAO Membership Tokens they hold. This ensures that every member, regardless of token holdings, can participate in governance issues as a DAO Member.

The current Nexus Mutual Ltd. legal entity provides limited liability protection for members of the mutual, and this is one key area where members’ protections are reduced on the move to statelessness. As stated in Section III.5, DAO Members agree not to hold each other liable for any activities within the Nexus Mutual DAO and this section is designed to retain as many of the existing protections as possible. However, Members should note that the move away from a legal wrapper will inevitably reduce liability protections to some degree. Risk is most likely to arise from actions taken by non-DAO Members against the DAO, and specifically against prominent members of the DAO.

Article IV: Binding Effect of the Designated Smart Contract

This section defines the DAO Members relationship with the Designated Smart Contract (i.e., the smart contracts that make up the Nexus Mutual protocol) and the rights granted to members by the Designated Smart Contract.

Section IV.2 Exception Handling: This section within Article IV outlines how the Nexus Mutual DAO would respond to “a Material Adverse Exception Event,” which is defined in detail in Article VI in Section VI.17. Material Adverse Exception Events. This can be summarized as any hack like event that leads to a loss of funds or results in funds being inaccessible to DAO Members. Should a Material Adverse Exception Event occur, the response and reporting procedure is outlined in detail for members to review.

Article V: Representations and Warranties

This section of the DAO Membership Agreement outlines the legal agreement each member must enter into if they wish to become a DAO Member.

Full Text of the DAO Membership Agreement

Members can review the full text of the DAO Membership Agreement DRAFT here: https://drive.google.com/file/d/1I7vx0AwBQUB_y5rb_tocAAJ-5iLdEjSL/view?usp=sharing

Asset Transfer Agreement

This document is the legal agreement between the Nexus Mutual Ltd., the private company limited by guarantee in the United Kingdom, and the Nexus Mutual Foundation, the proposed Panama Private Interest Foundation created to hold the mutual’s assets during the transition between the UK legal entity and the future stateless DAO. The Nexus Mutual Foundation would hold the assets and DAO Members would be the beneficiaries of the assets held within the Foundation.

The Asset Transfer Agreement outlines the parameters and procedures involved in the asset transfer between the two legal structures. This is a necessary step in the transition to a stateless DAO.

Members should note: The amounts included within the Asset Transfer Agreement will be determined at the date of transfer. The current values included in this draft are placeholders.

Full Text of the Asset Transfer Agreement

Members can review the full text of the Asset Transfer Agreement DRAFT here: https://drive.google.com/file/d/1M8tP89x04qH2nbPTIgl9J9FpfowSXfgS/view?usp=sharing

Bylaws of the Foundation

This document details the necessary requirements to establish the Foundation; the responsibilities of the Foundation; the powers, duties, and obligations of the Foundation; the Beneficiaries the Foundation represents (i.e., DAO Members); the distribution of interest and profit to Beneficiaries of the Foundation; the ability to amend the Bylaws in the future; the Foundation’s ability to resign; process to dissolve and liquidate the assets held by the Foundation at a future time; and the legal dispositions outlined in the Bylaws of the Foundation.

Full Text of the Bylaws of the Foundation

Members can review the full text of the Bylaws of the Foundation DRAFT here: https://drive.google.com/file/d/1FShl321zQjiMot5bw9cSZw8Qy1f_6gBd/view?usp=sharing

Member Comment and Review Period

Members initiated an exploratory review of the necessary requirements and possible path forward to transition to a stateless DAO structure. After the initial Operation Wartortle grant was approved by members of the mutual, the Nexus Foundation sought legal guidance from Norton Rose Fulbright, which the mutual made available to members and Hugh summarized. At that time, the Nexus Foundation sought out tax advice from a premier global law firm to offer guidance on the possible impact and best way forward for members to transition from the Nexus Mutual Ltd. UK legal entity to a truly stateless DAO.

The core team has worked in the interest of members to provide a possible solution that would best serve members as the Nexus Mutant community looks toward a stateless future. There is no example to follow, as no other protocol has sought to dissolve a legal entity to transition to a stateless DAO structure. Members of the mutual should take the time to review these foundational documents, provide comments, and ask questions as the mutual contemplates an unprecedented process to become stateless.

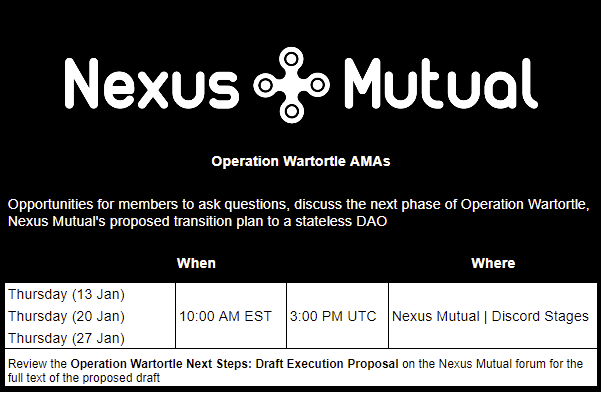

This forum post will be left open for members to review and discuss. After the holiday break concludes and we enter 2022, the mutual will host townhall and AMA-style events on a weekly basis to provide members with the opportunity to ask questions and learn more about the proposed next step in Operation Wartortle.

DISCLAIMER: This does not constitute legal, tax, or accounting advice of any kind and should not be relied upon as such. This is for discussion purposes only. You should consult your own legal counsel and independent advisors with respect to any and all matters. The ideas and concepts are presented here in order to start a conversation among community members in response to certain members requesting additional information regarding the legal structure of Nexus Mutual Ltd. and its members.

Although the material contained in this website was prepared based on information from public and private sources that Nexus Mutual believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and Nexus Mutual and individuals who prepared this website and the information herein expressly disclaim any liability for the accuracy and completeness of information contained in this website.

This website is distributed for general informational and educational purposes only and is not intended to constitute investment advice. The information, opinions and views contained herein have not been tailored to the investment objectives of any one individual, are current only as of the date hereof and may be subject to change at any time without prior notice. Nothing contained in this website should be construed as investment advice. Any reference to an asset’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal objectives, needs and risk tolerance. Nexus Mutual and individuals who prepared this website and the information herein expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.

The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any assets or securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service.