Introduction

Currently, we have excess ETH in the capital pool which is not earning yield. Right now, roughly 20% of the capital is staked in Lido while the remaining 80% is held in ‘cash’.

As we work to cover ETH 2.0 slashing risk, it makes sense for us to look for avenues to earn yield on our ETH outside of staking. One of the few options is to lend ETH, but the yield is typically incredibly low because demand is relatively small given the ease of borrowing in stables, and the supply of ETH lending is high.

Rationale and Understanding Maple

The exception to this rule is large ticket size, undercollateralized lending to institutions, funds and DAO’s. Currently the best platform for this is Maple Finance which has issued more than $1bln in loans since its launch 10 months ago. As the collateral decreases, rates will naturally increase to compensate for the additional risk, which is why the vast majority of loans of Maple are not only undercollateralized, in fact they have zero collateral.

For all intents and purposes, it’s best to think of these loans as zero collateral, as this is the most likely scenario. Instead of relying on collateral, Maple loans are enforced by legal contracts (Master Loan Agreement), governed by NY State law. Ultimately, the bet is that the borrower will not default on the loan, and if they do, that recovery will to some extent be possible. Therefore, the most important role is in assessing the creditworthiness of the borrowers. On top of that, the pool is protected by the so-called pool cover (aka junior tranche) that serves as a first loss capital in case of a default.

Maven 11 Pool

To assess the risk of a borrower and establish terms of the loan, Maple introduced a concept of Pool Delegates with Maven 11 running two permissionless pools (USDC and wETH). Besides being an investor in Maple, Maven 11 opened a brand new lending division within their firm to manage the pools and perform the credit risk analysis on the borrowers. For this purpose, they dedicated a total of 4 FTE including one quantitative analyst with a risk management background, external advisor who has over 10 years of experience in high-risk loan origination and credit risk management who currently manages a EUR 2B credit book in his TradFi job but equally has been a DeFi participant for years and shares their passion and conviction to the space. After the successful launch of the USDC pool, they also added a junior with credit background and a director spearheading their institutional sales with over 15 years experience in capital markets including managerial roles at Kempen & Co, KBC Securities and NIBC.

Risk and Reward

Much of the risk associated with no collateral loans to these funds and institutions is mitigated by the size of the loans relative to the balance sheets of these funds. Most of these funds act as market makers, where continuous streaks of profitability into the 18 months+ are not uncommon (e.g. Alameda, Wintermute). These are reliable businesses that deploy market-neutral trading strategies i.e. don’t face directional exposure to the underlying assets. Even under relative black swan events these strategies have proven to be resilient and this helps to explain why it’s possible to lend to them, without collateral, and expect a positive return over the long-term.

Currently, the returns on ETH lending with Maple and Maven 11 are ~ 9%. The ETH lending generates ~ 4%, while MPL rewards generate ~ 5% (subject to the $MPL price fluctuation). Obviously, the rewards currently make up the majority of the yield and at some unknown point in the future, these rewards will have to reduce, or stop completely. This is true across all of DeFi, not just Maple. This is a risk to keep in mind, as the 4% return solely from the lending would be unacceptable in my opinion, as the risk is greater than staking and the return is lower.

But as a combined yield, currently, the return is very competitive. As ETH staking yields increase post-merge, as many believe will happen, the yield on lending ETH should increase as well, as the supply of ETH lending will alter, and demand for borrowing will increase with ETH staking rate becoming a benchmark borrow rate.

How does lending work in detail?

This wETH pool by Maven11 is very new, and we’ve been involved behind the scenes for many months working towards getting comfortable with this strategy. The pool itself allows depositors to deposit wETH, which can then be lent out by Maven 11 when terms are agreed to with their group of borrowers.

Each borrower will get their own terms, for individual loans, depending on their credit worthiness, the term, the size, the collateral, the interest rate and the alternative demand for borrowing.

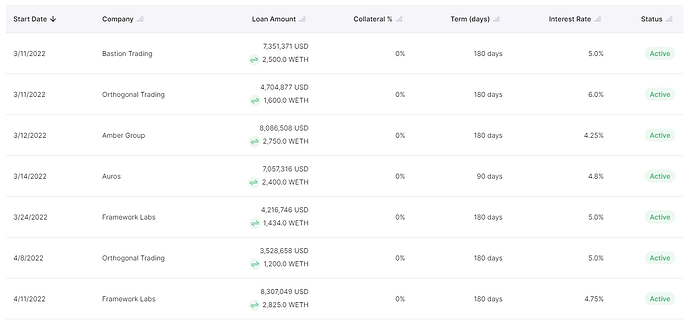

Loans are typically for 90-180 days, with an average interest rate of 5% (the lower APY above accounts of time when funds are stagnant). So far, seven loans have been made since early March. The details are here:

wETH is deposited into the pool, and an LP token is received. That LP token can then be deposited into a second pool to earn MPL rewards.

Once deposited, funds are locked-up for 90-days before they can be removed. After 90 days, if the lender wants to leave the pool, they start a so-called cooldown period that lasts 10 days. Cooldown period allows the pool delegate to prepare the required amount for the lender ahead of time. When the 10 day period passes, the lender has 48h to withdraw the funds. If the lender misses the withdrawal, they need to trigger the 10 day cooldown period one more time.

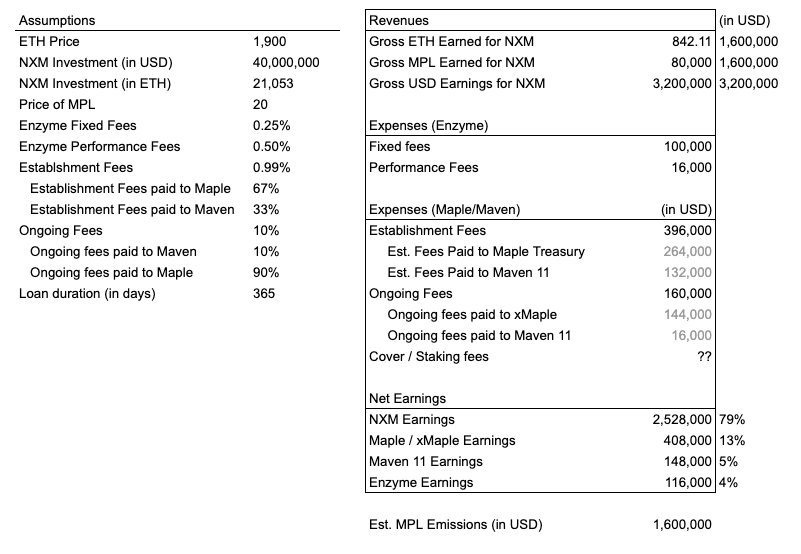

The pool delegate (Maven11) earns a 10% fee from the pool of interest earned, and an additional 10% goes to those providing ‘cover’ for the loans. On top of that, pool delegate receives ⅓ of the 1% annualized establishment fee that is charged from the principal loan amount. The remaining ⅔ of the 1% annualized establishment fee is flowing into Maple treasury which will be used to buy back MPL on the open market and distribute to xMPL stakers (new tokenomics).

Cover refers to a pool of capital which is staked to act as a first-loss tranche in the event of a loan default. This cover is fully burned before any of the lender’s capital is impacted. Currently, there is 763,657 USD in cover, which is provided from Maven 11 themselves (Pool Delegate and venture fund). The first figure represents 1.77% of the principal at risk. Therefore, lenders would only be hurt when a default results in the loss of more than 2.37% of the principal. Currently, the only way to provide pool cover for the pool is to add liquidity to the wETH:MPL pair on Balancer which faces IL, in the upcoming weeks single sided staking will be enabled which is expected to bring more capital to the pool cover as the issue of IL will be mitigated and stakers will be rewarded with 10% of all interest payments in the pool (pure wETH yield). Maven 11 is also committed to increase their allocation towards the pool cover once single sided staking will be implemented.

To summarize, depositing wETH in the Maven 11 liquidity pool on Maple Finance will generate two different types of yield: yield in wETH, and yield in the MPL governance token.

- wETH yield, as reported, has a target of ~ 4% APY. This yield is released on an ongoing basis as the interest payments are paid.

- MPL reward token yield, boosting expected total APY to ~8-10%. These MPL rewards are released on a block by block basis.

The APY itself is dependent on 3 factors:

- Interest rates - when the interest rates among the borrowers in the pool are increasing, the wETH part of yield is increasing as well (and vice versa).

- Amount of liquidity in the pool - when the pool increases in size, the rewards in MPL are decreasing proportionally as the number of MPL tokens needs to be distributed among a larger number of participants (and vice versa).

- MPL price - when the price of MPL is increasing, the rewards in MPL are higher in $ terms, effectively increasing the APY (and vice versa).

Proposal

At scale, this is one of the few strategies that allows us to deploy 8-figures ($ terms) and earn a competitive yield for the foreseeable future. I believe that this strategy has a risk profile that’s acceptable, given the mutual’s liabilities, for up to 10% of the capital pool. This % might change as the borrowers change, both in number and quality, as the level of collateral alters, and as alternative yield sources change. On top of that, to allow for maximum utilization of the capital provided to the Maven 11 pool, the 10% allocation will be deposited in tranches. This way only the capital demanded by the borrowers will be deployed to earn yield which will prevent dilution of the pool. We aim to deploy the first tranche of $20-25 million immediately.

My proposal is to allocate 10% of the capital pool value to lending wETH with the Maven11 pool on Maple Finance.

It would be also beneficial to discuss what can be done with the MPL rewards. There are 3 options:

- Sell continuously to lock in the rate

- Stake MPL to xMPL to receive MPL rewards

- Option 2 + use the xMPL to provide the pool cover and earn extra 10% of interest payments in wETH

My suggestion is that we pursue option 3 with half of the MPL rewards, and continuously sell the other half to lock in the rewards. Given the size of our investment, rewards will be substantial and excessive selling is likely to lead to large slippage. I also have a long-term positive view on Maple, and think there is a benefit to accruing additional MPL tokens.

There is a limit to how much pool cover can be provided in a capital efficient manner, so once the pool cover is at 10% of the pool size, we should refrain from adding additional cover. Instead, excess returns beyond this point should be sold as efficiently as possible to maximize the achieved APY.

Technical Integration

In terms of bringing this to life, the easiest way is for us to use Enzyme. For those that don’t know, Enzyme is an asset management protocol that allows you to create a pool, interact with smart contracts and hold assets.

Given that every asset that we hold in the capital pool increases the gas costs of operating Nexus Mutual, and running this Maple strategy would require a price oracle, doing it inside of Enzyme simplifies this. By doing so we can get this live in a couple of weeks, rather than months.

The cost of doing so will be:

- 25bps in fixed fees on the assets in the pool

- 50bps in performance fees on the profit in the pool

Presuming an 8% APY (on the lower end of our predicted range):

40m * 25bps = $100k per year in protocol fee for usage of the platform (standard fee for every vault, not specific to us)

40m * 8% * 50bps = $16k per year in “management fees”

40m * 8% = $3.2m in APY per year.

Net of fees, we’re looking at $3,084,000 on a $40m base, or 7.71% APY after fees.

Useful links:

Lido proposal: https://research.lido.fi/t/yield-generation-on-maple-finance/1620

Rook proposal: https://forum.rook.fi/t/kip-draft-yield-generation-on-maple-finance-weth-pool/267

FAQ Lenders: https://docs.google.com/document/d/1cIp1ldtfNN3w5rr1bs7H9gEYRI_1jDwWkIxyGE_BgI4/edit

Token Terminal: https://tokenterminal.com/terminal/projects/maple-finance