Nexus Mutual - Community Fund - DPI INDEX Proposal

Co-authors: funkmasterflex, Marc (Miza 6), Matthew Graham, @HelloShreyas

We appreciate the assistance and insights from @Dopeee and the groundwork done by the Investment Hub including @Rei, @aleks, @nsantini, @Gauthier, @oSaaT, and @JC1

Basic Summary

We are requesting feedback from the Nexus community regarding Index Coop Products and propose to invest a percentage of the Nexus Mutual capital pool into the DeFi Pulse Index (DPI). This proposal is following the Investment Hub Update forum post written by Rei mentioning further research on passive/index strategies like DPI.

The DPI is a capitalization-weighted index that tracks the performance of the top DeFi tokens. It is currently composed of 16 popular DeFi tokens available on Ethereum. The methodologist behind DPI is Pulse, Inc, creators of DeFi Pulse and the criteria for token selection can be found here.

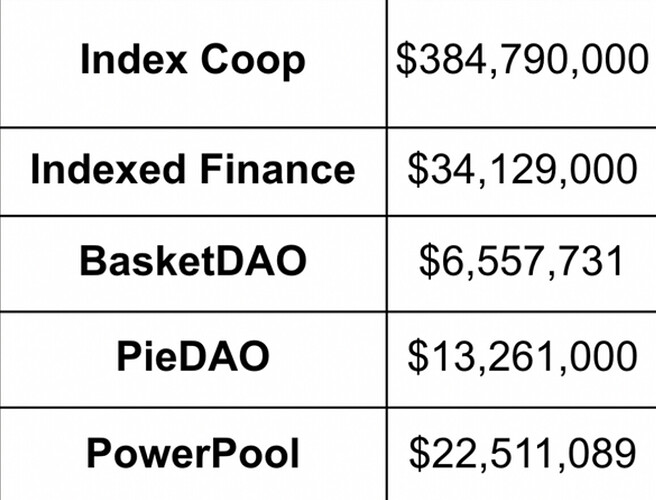

DPI is the most popular DeFi index product with, at the time of writing, ~$200M of market cap. A 0.95% annual fee for the management of this product. It covers the costs with portfolio rebalancing and the implementation of the methodology.

DPI is built on top of Set Protocol and managed by Index Coop. Index Coop is a decentralized and autonomous asset manager governed, maintained, and upgraded by INDEX token holders.

Motivation

The main purpose of this initial investment into DPI is to fulfill the goals outlined by the Investment Hub; maximize the return obtained on the assets sitting in the capital pool, while minimising associated risk.

More specifically, the Investment Hub’s objective is to create a diversified portfolio of assets while ensuring sufficient liquidity to meet cover obligations. By gaining exposure to a diverse basket of top DeFi projects, Nexus Mutual can build a larger capital pool while still meeting all of these goals.

DPI is an efficient way to get exposure to the DeFi sector. The index gives exposure to all the component tokens while only having to hold one single token. The top 7 tokens of DPI represent ~90% of the Index portfolio (Uniswap, Aave, Maker, Compound, Sushi, Yearn and Synthetix). It is more efficient to pay the 0.95% annual management fee than do the implementation alone, spending with gas and development costs to do the rebalances.

Nexus Mutual provides cover to 15 of 16 projects within DPI and 227.6k ETH of total coverage. In addition, the Mutual has 10.5k ETH of cover on Set Protocol V1 and V2.

Risk Assessment

The following assessment is based on the “Qualitative vs. Quantitative Risk Assessment” outlined in the Investment Philosophy forum proposal.

Illiquidity Risk: DPI can be liquidated in 72 hours or less (Low Risk)

Minting and redeeming DPI represent the primary market of the indices, but many users can buy and sell indices on the secondary markets. The price on the secondary markets are kept at Net Asset Value (the market value of all the underlying components) through a network of market makers that redeem the tokens when price is below NAV and vice versa.

When considering liquidity, the average daily trading volume is $7.75M, based over a trailing 90 day trading period. However, as DPI holders have the option to mint/redeem the underlying tokens within DPI, it draws on the liquidity of the underlying assets and also allows for any deviation from NAV to be arbitraged away by traders.

Basis Risk: Medium Risk

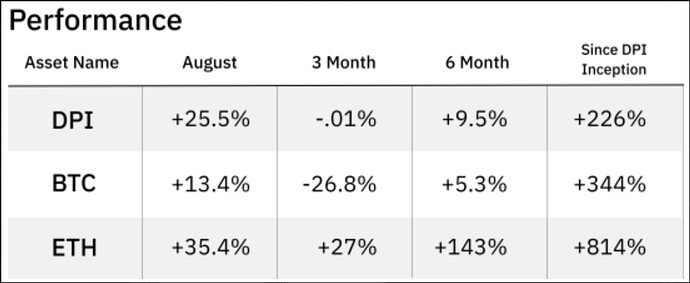

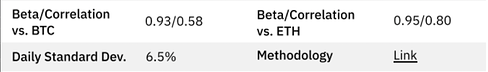

As DPI is a basket of tokens, it has less volatility than the component assets by themselves. This is reflected by DPI having a standard deviation of 6.5% considering the last 6 months.

As shown in the table below, DPI has performed in line with BTC and ETH since inception, at the cost of a 1-2% increase in volatility depending on the benchmark. The correlation of DPI with ETH is 0.80 and with BTC is 0.58. It is a way to diversify a bit from only holding ETH.

Protocol Risk: Lower Risk

84% DeFi Safety Score

Set Protocol V2, and therefore DPI, was audited by OpenZeppelin in September of 2020, launched early October 2020, and has over 150,000 user transactions. Additionally, audits from Chainsecurity and Trail of Bits were completed on Set Protocol V1.

Liquidation Risk: No liquidation risk (Lower Risk)

Leverage Risk: No leverage (Lower Risk)

Counterparty Risk:

DPI holders have no governance influence on Index Coop or the protocol within the index. The DPI utilizes TokenSets V2 smart contract that has privilege roles in many of the contracts. The key findings from the audit are highlighted below:

- The Controller contract has an owner that chooses the contracts that comprise the system. This includes all of the modules, resources and the factories that can be used to make Sets.The owner also has the ability to remove Sets as desired, and specify protocol fees and other fee types that conforming modules will pay. Moreover, user deposits are achieved by granting token allowances to the Controller, so a malicious owner could deploy a module that simply takes these tokens.

- The IntegrationRegistry tracks third party integrations that can be used in the system. It also has an owner that can add, remove and edit the integrations as desired.

- The PriceOracle has a list of oracles and adapters that can be used to retrieve third party prices. It also has an owner role that can choose the supported oracles, adapters and price pairs.

- A malicious or poor choice of token contracts can undermine the value of the Set, so it is up to the set creators to choose sensible component distributions, and users will need to trust the creator or validate the choices.

There is a multisig responsible for initiating rebalances, performing meta-governance, adding / removing new protocol functionality. It does not have the ability to arbitrarily move underlying assets, mint tokens, etc. The signers are currently members of the Set team with the intention to add Index Coop community signers over time. While the multisig can’t arbitrarily move assets, it theoretically could rebalance assets into a fake token. The mitigating factors for these risks are the Set Labs, DeFi Pulse and individuals personal reputation.

Implementation

There are several methods available for purchasing DPI.

This initial proposal is to gauge support, if it is decided that it would be in the best interest of the community, we can determine the best way to implement the sale. Some examples, direct buy through Token Seats, Bonding Curve, Marketmaking Partners, Balancer pool.

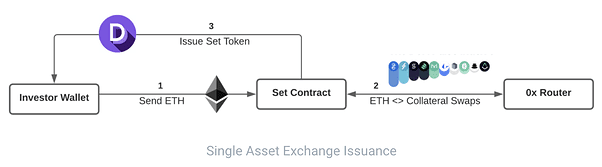

For large trades TokenSets offers investors the ability to “Buy” DPI via exchange issuance. Investors are able to send ETH, receive DPI and in the background the individual underlying assets are purchased. The “Buy” functionality draws on the liquidity of the underlying assets within DPI.

A bonding curve was recently utilized by FEI/Tribe for a $25 Million purchase using PCVSwapper code (recently increased to $50). This is audited code written to buy DPI on secondary markets. We can specify a value and frequency to minimize price impact. This would require a Chainlink Oracle.

Other alternatives are a custom Balancer pool or we can work with our Market Making partners to facilitate trading that will minimize price impact of a large sale.

Again, this proposal is to open discussion on if Nexus should diversify its treasury, we can discuss “The How” as a next step. We are open to discuss what would be the best implementation strategy.

Other Treasury Considerations

The purpose of this post is to spark a productive conversation between our two communities. Nexus Mutants and Index Coop Owls are well aligned on many aspects within crypto and DeFi; risk management being most critical. As the Nexus capital pool continues to grow and minimal capital requirements fluctuate, we are happy to discuss other correlated and non-correlated investments such as MVI and DATA.

Upcoming products like Pulse Aggregate Yield for tokenized stablecoin yield and more productive indices like Yield Hunter Index may also fit well. The Index Coop Community and our internal treasury team are excited to endeavor into more collaborative research regarding treasury management strategies.

Voting Rules

We would like to gather feedback from the community about this post and invite communities to discuss how a DPI purchase could benefit Nexus Mutual.