Last call for comments, review period: 19–25 June

Snapshot signaling vote: Open for voting between 26 June until 3 July.

[RFC]: Restart Enzyme vault & diversify ETH across staking providers - continued

Hi all, @moss @elisafly, @buendiadas @gainzley here, posting from Avantgarde Treasury (the Treasury Management arm of Avantgarde Finance).

INTRODUCTION

This second RFC marks the second significant governance milestone following the first RFC we shared on March 30, 2023. Having gathered feedback from community members, we are excited to present a formal improvement proposal that aligns with the specific needs and requirements of Nexus and follows the new guidelines stemming from the investment philosophy 2023 review and investment proposal template.

SUMMARY

In terms of strategy, our objectives encompass maintaining a consistent long exposure to ETH, earning rewards through ETH native staking, and mitigating various risks through diversification, due diligence and continuous risk monitoring.

Our proposed approach involves deploying the ETH currently held by Nexus on the Enzyme vault to a carefully selected group of ETH native staking providers. These providers consist of diverse node operators, offering exposure across different geographies, regulatory jurisdictions, and operational setups. For a more comprehensive overview of operational risks, diversification goals, and benchmark results, we invite you to read our detailed report.

To provide this important a-priori due diligence and ongoing monitoring services, Avantgarde proposes a total AUM-based annual flat fee that we consider very competitive when compared to LSTs fees and taking into account the premium nature of this service.

RATIONALE

Staking has evolved into a vital pillar of the Ethereum ecosystem. Failing to embrace diversified staking practices would result in the DAO diluting its potential and neglecting its contribution to overall network security and decentralisation. The importance of diversifying Ethereum staking providers cannot be overstated, as it serves to mitigate risks associated with staking. Relying solely on a limited set of staking providers exposes one to potential economic penalties, operational disruptions or regulatory crackdowns.

To illustrate, consider the scenario where you rely on a solitary staking provider utilising a hosted service that receives a directive to cease its services to crypto companies. Such an event would lead to severe penalties for both Nexus and the network. It is imperative to thoroughly assess and evaluate these types of risks, implementing specific mitigation measures programmatically to ensure the ongoing stability of treasury management.

By adopting a diversified approach to staking providers, Avantgarde can proactively safeguard Nexus against such contingencies, thereby fortifying the continuity of its Capital Pool in the long run.

Regarding infrastructure, our aim is to establish direct connectivity with staking providers via the existing Enzyme vault while leveraging audited smart contract integrations. This job would qualify as low risk as per the risk scorecard defined in the investment philosophy since we avoid complex layering of protocols and associated risks. More details on that in the specific paragraph on risks.

Another advantage of this choice is the utilisation of the Proof of Reserve Chainlink Oracle, a custom development effort that our team carried out for Nexus in 2022, which allows Nexus Mutual smart contracts to know the exact value of the investment in real time.

PROPOSAL SPECIFICATIONS

The proposal aims to achieve discretionary and risk-managed native staking through the establishment of a carefully curated library of selected node operators, coupled with a dedicated risk monitoring infrastructure. A concise summary of the report outlining this approach to discretionary ETH can be found in the image below.

| Criteria | Objective | Key Result |

|---|---|---|

| Past track record | Identify history of uptime, security incidents, and other operational metrics that can affect the likelihood of future slashing. | Aiming at having a portfolio of providers with no major security incidents and min. participation rate of 99.5% |

| Provider diversification | Mitigate risks related to a single provider while promoting decentralization of staking services | Aiming at having a portfolio of minimum 5 different providers (aim at 10 longer term). |

| Geographic location | Mitigate regulatory, operational and natural disaster risks by diversifying across different geographies. | Aiming at having a portfolio of providers hosting from at least 3 world regions initially and growing to more than 5 longer term. |

| Operational setup | Mitigate risks associated with server/hosting risks in particular. | Aiming at having a portfolio which diversifies across server setups. |

| Fees & rewards | Improving standard commercial terms while ensuring best-in-class service. | Aiming to strike commercial terms that are more competitive than LSTs like Lido or Rocket Pool (<10% fees) |

| Risk monitoring | Mitigate potential risks, such as withdrawal process and maintain the DAO up to date with risk metrics | Aiming at creating and improving a specific risk matrix for staking providers and having an alert system in place. |

| Consensus client | Mitigate downtime risks coming from single consensus client | Aiming at not having more than a 50% of nodes running on a single consensus client |

This active framework brings significant advantages to the Mutual by offering a complementary diversification strategy that extends beyond Liquid Staking tokens alone.

The Mutual cannot get direct exposure to emerging LSTs tokens that do not have a price oracle or sufficient liquidity on-chain. This limitation also affects Enzyme, which relies on Chainlink for its secure price feeds. So the suggestion made by @GordonGekko in his latest comments is unfortunately not viable. Nevertheless, the true value of this proposal lies in Enzyme’s ability to provide direct accessibility to a diverse range of node operators while ensuring a consistent Proof of Reserve in ETH across all staking positions. This audited on-chain formula plays a pivotal role in computing the exact value of the investment in real time and the important comparison with the Nexus MCR, thus making it a key element of the overall yield-seeking treasury program.

After consulting with the Nexus Investment committee the proposed approach is to start with a 50% allocation of the currently idle WETH to Kiln (6,624 ETH rounding up increments of 32 ETH) and leave the rest idle for the moment until Stakewise V3 is successfully integrated and audited (ETA mid July 2023).

MONITORING

For full details on the risk monitoring and mitigation measures, please refer to the full report here. The table below is a high-level summary of the report.

| Staking risks | Risk definition | Key Mitigation |

|---|---|---|

| Client Concentration | Bugs in a validator client could be exploited to make inaccurate attestations. | Build monitoring infrastructure, diversify investments based on client balance. |

| Slashing risk | Penalization for negligence or malicious validation | Select high-performing node operators, exclude inconsistent ones. |

| Centralization risk | SLAs may not include all possible unfavourable circumstances | Choose reliable service providers with clear SLA terms. |

| Liquidity risk | High demand to withdraw ETH. This results in a long withdrawal queue | Monitor closely staking and withdrawals, mitigate liquidity risks. |

| Regulatory risk | Regulators could introduce new rules that could negatively impact the staking operation | Diversify staking across regions, avoid hostile regulatory environments. |

| SC risks | ||

|---|---|---|

| Risk of hacks & exploits | Risk of loss due to potential bugs or hacks | Avantgarde maintains a strong security track record through audits, monitoring, and in-house expertise. |

| Staking connectors risks | Risk of a validator refusing to unstake and taking funds hostage | Using sharding to distribute both validator and exit signatures across a network of oracles. |

| Oracle risks | Risk of oracle being compromised or manipulated | Exploring extra providers for diversified on-chain price feeds. |

| Contract Upgradeability | Risk of unwanted or forced upgrades of the contract version | Enzyme users have discretion in adopting upgrades with an opt-in option. |

| Governance risks | Risk of adverse decision from the governance body | Enzyme Council acts in the user’s best interest and can’t impact vault owners’ code. Users responsible for upgrades and instant share redemption if needed. |

TECHNICAL REQUIREMENTS

In terms of engineering efforts, the most efficient path to achieving our stated goal is through Kiln, a fully integrated and audited solution, combined with the integration of Stakewise V3.

This extra integration will grant us a permissionless approach to engage directly with different validators, opening up numerous direct staking opportunities. We anticipate including this protocol in our upcoming audit slot scheduled for July 2023. This timeline aligns seamlessly with our objectives and provides time to start developing the required research library for the initial portfolio and establish the necessary monitoring infrastructure, a task estimated to be completed within conservatively 6 months starting from the successful implementation of this proposal.

Furthermore, the involvement of the Mutual’s Engineering Team is not anticipated, ensuring their undivided focus on current priorities at hand.

FEES & ONGOING EXPENSES

To provide this important a-priori due diligence and ongoing monitoring services, Avantgarde proposes a total AUM-based flat annual fee of 0.3% (inclusive of protocol fee). This fee would be ongoing and no set-up fee is required in the context of this proposal.

At the current rate of staking APY%, this fee would correspond to about 6% of the annual staking rewards accrued. We consider this management fee + native node operators’ fees to be very competitive when compared to LSTs fees and to be in line with the requirements expressed by the Mutual in response to our initial RFC. This is especially true when taking into account the premium nature of this dedicated discretionary service.

REWARDS

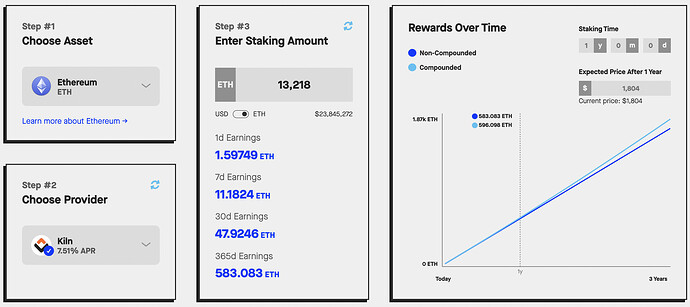

As an important premise, ETH is considered the “cash” asset, therefore the fluctuations of ETH in USD terms do not affect the pessimistic or optimistic scenarios. For simplicity, we just assume that the price won’t change over the simulation period. Also, for simplicity we consider the projections made with Kiln as sole provider when in fact a combination of Kiln and Stakewise V3 will be included in the scope of this proposal.

Expected Scenario

- Staking ratio of 30% (increasing from the current level of approx 18%)

- Effectiveness rate of 96%

- Attestation Participation Rate of 99.5%

- Annual fixed costs of 0.3% AUM

Source: Staking Interest Calculator

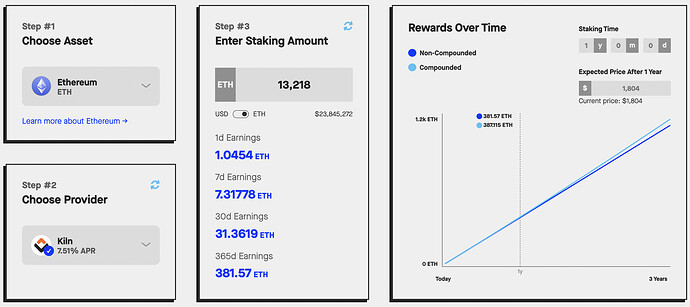

Pessimistic Scenario

- Staking ratio of 50% (increasing from the current level of approx 18%)

- Effectiveness rate of 93%

- Attestation Participation Rate of 98%

- Annual fixed costs of 0.3% AUM

Source: Staking Interest Calculator

RISKS

Based on the list of risks laid out in the investment philosophy, and the fact that the capital allocated on the Enzyme vault is less than 10% of the capital pool, we believe this strategy qualifies for the lower risk category.

| Risk | Score | Lower Risk | Medium Risk | Higher Risk | Comments |

|---|---|---|---|---|---|

| Illiquidity Risk | Can be liquidated in 72 hours or less | Can be liquidated in 7 days or less | Liquidation takes more than 7 days | Locking up capital for periods of time presents risk to the balance sheet should the mutual need those funds to pay claims. Note that the risk buckets here refer to liquidity in non-stressed scenarios. Stressed scenario liquidity is also a consideration but difficult to quantify. | |

| Basis Risk | ETH denominated | High to medium correlation with ETH | Little to no correlation with ETH | The balance sheet is largely ETH denominated. ETH and DAI are effectively ‘cash.’ Investing in other tokens introduces basis risk. | |

| Protocol Risk (DeFi Safety Score) | DeFi Safety Score >=80%; simple design | DeFi Safety Score >=80%; Newer protocol; composability (2 layers) | DeFi Safety Score >=70%; 3 or more protocol layers | Putting funds in a vault or liquidity pool to earn a yield opens up our funds to risk of loss from smart contract hacks. | |

| Liquidation Risk | No liquidation risk | Max 20% expected loss in liquidation | 20%+ expected loss in liquidation | In the case of lending, Nexus collateral could be at risk of liquidation | |

| Leverage | No leverage | 10% net leverage | 10%+ net leverage | Leverage may either be an explicit component of a particular strategy, or embedded leverage (Options, Futures, etc.) | |

| Counterparty Risk | 20% exposure to a single counterparty or less | 20%-30% exposure to a single counterparty | 30%+ exposure to a single counterparty | Other additional qualitative & quantitative measures of counterparty risk may be used to assess investments & managers | |

| Economic risk | Negligible possibility of loss as a result of investment | Limited loss possibility | Unlimited loss possibility | Some investments may result in losses on a short term basis, e.g. impermanent loss. |

Regarding protocol risks, we believe this job still qualifies as low risk since we avoid complex layering of protocols and associated risks. Kiln and Stakewise V3 have a simple design that is not comparable to composable strategies through complex smart contracts. You can find more info about Kiln’s security here Stakewise V3 here.

In terms of governance risks related to the future versions of the Enzyme smart contract, the vault upgrades are never forced upon vault owners, they are simply recommended when a new version becomes available. Each vault owner must proactively opt-in in order for the upgrade to take place so there is no scenario where users are coerced into the contract migration. Read more here.

CLOSING REMARK

Given the rapid increase of the deposit queue, we urge the Mutual to move the proposal swiftly through the governance process in order to limit the additional lead time the activation process will take before it starts to generate actual rewards.

As always, we are very happy to have the opportunity to support Nexus and we remain open to any additional feedback before we move on to the next phase. ![]()

Proposal Status

This RFC was posted on 7 June, and the Investment committee has issued a last call for comments during the next week (19–25 June)!

They want to hear your feedback and comments on this RFC before a non-binding Snapshot signaling vote is opened to gauge member sentiment regarding this RFC proposal.

Status:

Open for comments: 19–25 June- Snapshot signaling vote: open from 26 June until 3 July

Edit: @BraveNewDeFi added the proposal status and timelines for review, per @Rei’s message in the thread below.

Edit 2: @BraveNewDeFi updated this RFC to include links to the non-binding Snapshot signaling vote at the start of this RFC and in the Status section.