Hi all, @moss @elisafly @eek637 @buendiadas here, posting from Avantgarde Treasury (the Treasury Management arm of Avantgarde Finance). Looking forward to hearing your thoughts and open to receiving feedback and adapting the proposal based on it.

INTRODUCTION

The Capital Pool’s position in the M11 Credit WETH Pool has been unwound. The steps to do so were clearly outlined here by @Dopeee, and have resulted in 13,218 ETH idle in your NXMTY Enzyme vault. This chunk currently represents ≃9% of the total Capital Pool.

Despite the above, the strategy of holding assets in an Enzyme vault where they can be managed by an individual or a firm in a trustless way rather than by governance can be viewed as successful. This setup demonstrated the value of being able to react to market events in real-time rather than via token vote. From a technical perspective, the implementation has been working live in production and holding significant value for more than 6 months (Aug 2022) with no technical or contract issues.

That said, there are some lessons around portfolio construction that can be taken away from the experience. Below, we suggest a new strategy to reboot and put assets to work for the Mutual.

OBJECTIVES

The objectives of the strategy are:

- Maintain directional long exposure to ETH

- Earn rewards from ETH staking

- Hedge against risks through due diligence, diversification & continuous monitoring

INFRASTRUCTURE

We propose to keep the assets in the Enzyme vault due to the following benefits:

- The non-custodial and trustless nature of the vault setup

- The transparency and 24/7 on-chain reporting capability

- The interoperability of Enzyme with Nexus due to dev work we’ve done in the past

- Operational simplicity & ability to act quickly in a rapidly evolving environment

- The possibility for Avantgarde to make future proposals that can be voted by Nexus and implemented on chain via the Enzyme vault and its trustless delegation.

- The optionality to sell ETH into stables in support of matching currency of assets & exposure if/when the DAO decides to move in that direction (though our view is that medium term there should be an ETH-denominated capital pool and a DAI-denominated capital pool, separate from each other).

STRATEGY

We propose:

- 25% of the ETH is used to buy Rocket Pool ETH rETH

- 75% of the ETH is staked natively amongst 3-5 top-tier node operators with the aim of diversifying the staking portfolio both geographically and operationally.

Important notes:

-

The implementation would take place after the Shanghai fork in order to avoid any illiquidity issues.

-

Fees charged by Enzyme/Kiln are substantially lower (8%) than fees charged by liquid staking derivatives (10 - 25%).

-

Deliberate exclusion of stETH: The NexusCapital Pool is already exceeding the 20% threshold and is also covering against Lido’s risk. We’ll monitor the situation and adjust recommendations if the situation changes.

-

Deliberate exclusion of cbETH for the time being: Given the current enforcement action that has been initiated, we think that the centralised redemption process of cbETH could represent an extra layer of risk. We will continue to monitor the situation and adjust if things change.

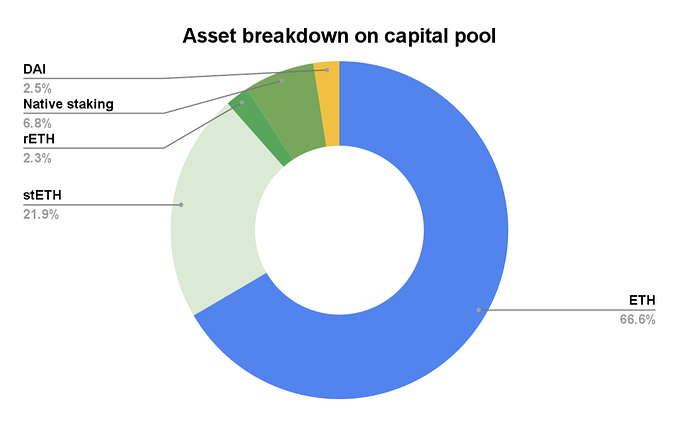

The capital allocation on the total Nexus capital pool would result in something like this:

AUM RAMP UP

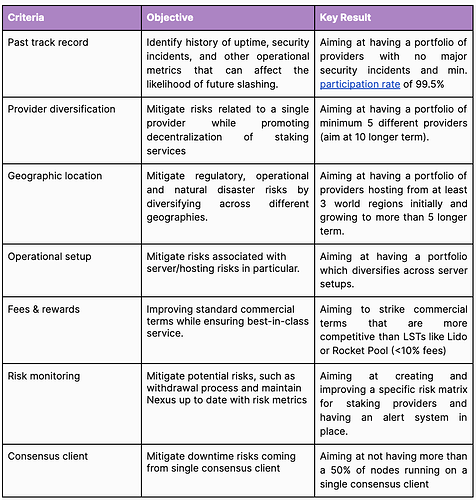

After the implementation of this first step, we propose a quarterly assessment of the status of the vault and the allocation of an additional 4,000 ETH per quarter so that ideally after 12 months the vault reaches an allocation that is in line with the criteria of max 20% of the capital pool per single manager/counterparty/protocol, as clearly outlined in your investment philosophy. This will help increase the overall performance of the Capital Pool.

FEES

0.5% fee (includes Enzyme protocol fee and Avantgarde management)

MONITORING & REPORTING

The monitoring can be done in real time 24/7 from the Enzyme app and we can also increase the level of customization with a dedicated whitelabel page that can be linked directly to https://nexusmutual.io/.

RISKS

Based on the list of risks laid out in the investment philosophy, and the fact that the capital allocated on the Enzyme vault is less than 10% of the capital pool, we believe this strategy qualifies for the lower risk bucket.

| Risk | Score | Lower Risk | Medium Risk | Higher Risk | Comments |

|---|---|---|---|---|---|

| Illiquidity Risk | Can be liquidated in 72 hours or less | Can be liquidated in 7 days or less | Liquidation takes more than 7 days | Locking up capital for periods of time presents risk to the balance sheet should the mutual need those funds to pay claims | |

| Basis Risk | ETH denominated | High to medium correlation with ETH | Little to no correlation with ETH | The balance sheet is largely ETH denominated. ETH is effectively ‘cash.’ Investing in other tokens introduces basis risk | |

| Protocol Risk (DeFi Safety Score) | DeFi Safety Score >=80%; simple design | DeFi Safety Score >=80%; Newer protocol; composability (2 layers) | DeFi Safety Score >=70%; 3 or more protocol layers | Putting funds in a vault or liquidity pool to earn a yield opens up our funds to risk of loss from smart contract hacks | |

| Liquidation Risk | No liquidation risk | Max 20% expected loss in liquidation | 20%+ expected loss in liquidation | In the case of lending, Nexus collateral could be at risk of liquidation | |

| Leverage | No leverage | Max 30% net leverage | 30%+ net leverage | Leverage may either be an explicit component of a particular strategy, or embedded leverage (Options, Futures, etc.) | |

| Counterparty Risk | 10% exposure to a single counterparty or less | 20% exposure to a single counterparty | 20%+ exposure to a single counterparty | Other additional qualitative & quantitative measures of counterparty risk may be used to assess investments & managers | |

| Economic risk | Negligible possibility of loss as a result of investment | Limited loss possibility | Unlimited loss possibility | Some investments may result in losses on a short term basis, e.g. impermanent loss. |

USEFUL LINKS

Avantgarde’s bio, Nexus Mutual’s Enzyme vault , Kiln <> Enzyme deck, Kiln’s validators stats, Nexus’s investment philosophy, Nexus’s Capital Pool, Mismatch currency of assets <> exposure explained

GOVERNANCE

The proposal will be put forward through the Nexus Mutual governance starting with this Request for Comments that allows for a period of review and feedback by the community. We are open to your comments / questions and to adapting this proposal accordingly.

If the governance process approves this investment, the implementation steps as outlined in the Technical section will be put in place by the Avantgarde Treasury team.