Hi all, @moss @elisafly, @buendiadas @gainzley here, posting from Avantgarde Treasury.

Summary

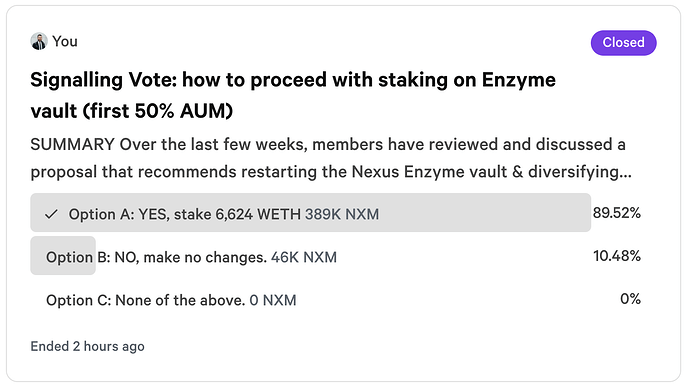

Over the last few weeks, members have reviewed and discussed a proposal that recommends restarting the Nexus Mutual Enzyme vault & diversifying ETH across staking providers. The non-binding Snapshot signalling vote has gauged positive members’ support for the proposal and it’s now time to move to the following stage of the governance process.

Rationale

The assets on the Nexus Mutual vault on Enzyme have been idle for the last few months. At the same time, the cost of the Proof of Reserve Chainlink Oracle has been a recurring operating expense that is not being offset by any revenues or yields. With this proposal Avantgarde proposes to put those assets back to work and start staking rewards for the Nexus Mutual Capital Pool, while ensuring that a diversified approach minimises the risks for the mutual.

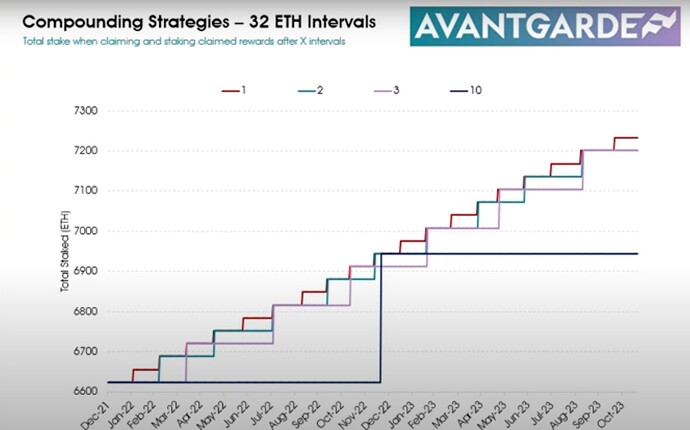

For more detailed information on the potential rewards, fees, monitoring strategy, technical details, and risks, you can refer to the [RFC]: Restart Enzyme vault & diversify ETH across staking providers - continued.

Expenses

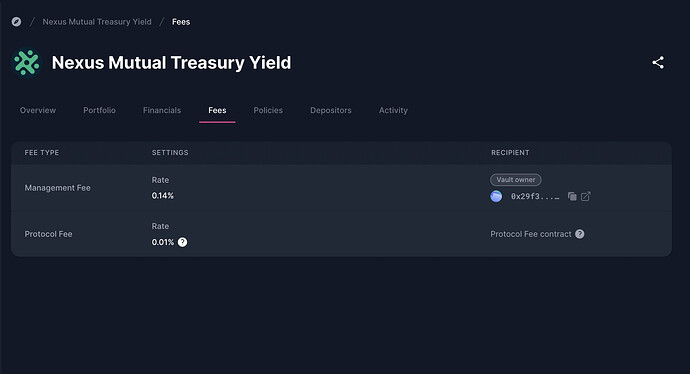

Avantgarde proposes a competitive flat annual fee of 0.3% (inclusive of protocol fee) based on total assets under management, while waiving half of the fees during the interim period in which the AUM is partially deployed. This final fee corresponds to around 6% of annual staking rewards at the current APY%.

Specifications

If members support moving this proposal forward, the following course of action will be:

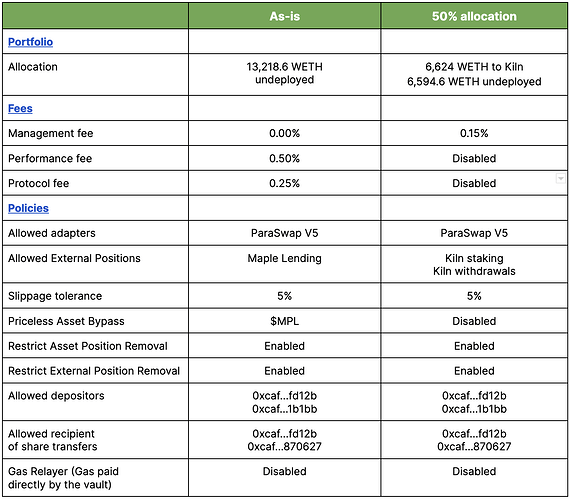

- Implement vault settings reconfiguration (see table below from As-Is → 50% allocation)

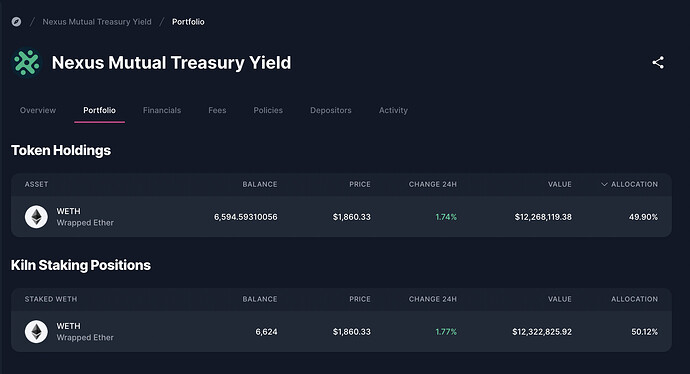

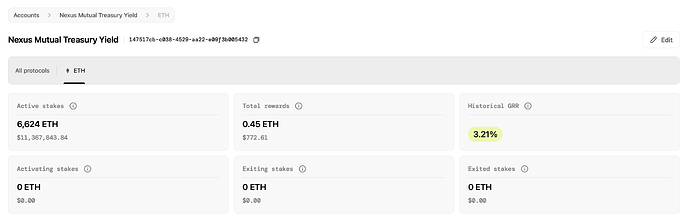

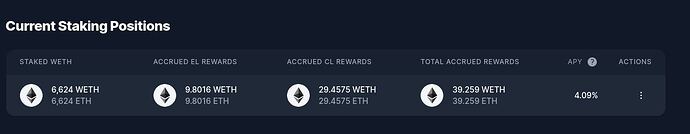

- Allocate WETH (6,624 WETH) to Kiln.

Important notes

- The “AS-IS settings” were configured for the previous investment allocation. For more information about that, you can check this post.

- No action is required from Nexus Mutual from a technical / engineering effort perspective.

- The protocol fee is disabled ad-interim, during the period in which only 50% of the capital is effectively deployed.

Proposal status

This proposal will be on the forum for review and comment from July 5th to July 11th, and it will be put to an on-chain vote on Wed July 12th. Previously, this proposal was posted as an RFC on the forum, after which time it was moved to a non-binding signalling vote.

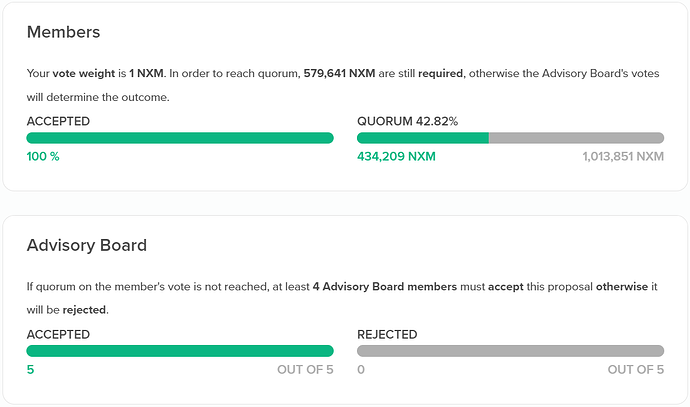

This NMPIP has been transitioned to an on-chain vote, which is open for voting from Wednesday (12 July) until Saturday (15 July).

Outcome of the vote

After the three-day voting period ended, members unanimously voted to approve an allocation of 6624 WETH from the Nexus Mutual Enzyme vault, which will be staked through Kiln and start generating the mutual additional staked ETH rewards.

After the 24-hour cool-down period passes, the Avantgarde team will update the vault parameters, per their proposal.

Source: Nexus Mutual UI in Governance tab