Dear all, this is @moss and @elisafly, posting from Avantgarde Treasury.

PREMISE

This new RFC marks a new significant step after NMPIP-196 was successfully passed in the summer of 2023 and staking through Kiln subsequently activated on 30 Aug 2023.

Having gathered feedback from members of the Nexus Mutual Investment Committee, and after taking into consideration the latest RFC [Divestment Framework] recently published by @Rei, we are excited to present this new RFC to Nexus Mutual DAO members.

We believe this aligns with the specific needs and requirements of Nexus Mutual and follows the guidelines stemming from the investment philosophy 2023 review and investment proposal template.

WHY ENZYME<>STAKEWISE V3<>CHORUS ONE

Nexus Mutual has a longstanding relationship with Stakewise, who were the first buyers of ETH Staking Cover. StakeWise was the first non-custodial liquid staking solution to launch on Ethereum back in early 2021. Its smart contract infrastructure is trusted by many entities in the space, from DAOs such as Aave to leading commercial operators.

Discussions between Nexus Mutual and Stakewise have taken place since the investment proposal back in May '22, which showed some early traction. However, it was then put on hold as Nexus Mutual awaited the release of Stakewise V3, which was audited and launched in Q4 2023. Since the initial proposal, StakeWise has upgraded its protocol to enable DAOs like Nexus Mutual much more control over their capital deployment. For example, DAOs can now cherry-pick their preferred node operators and negotiate bespoke commercial terms with such operators. After a period of consultation with multiple node operators, Chorus One has emerged as the operator of choice. More details on Chorus One can be found in the next paragraphs.

Finally, given the difficulty for Nexus Mutual to allocate engineering effort (bandwidth & costs) to enable direct Capital Pool deposits into Stakewise v3, the choice of the Enzyme route is deemed to be the most accessible and convenient. On the Enzyme side, the specific protocol engineering work was carried out and the protocol adapter Enzyme <> Stakewise V3 was successfully shipped + audited.

SUMMARY

The strategy focuses on maintaining a consistent long exposure to ETH, earning rewards through ETH native staking. The proposal involves staking the idle ETH (currently 6,585.02 ETH) on Chorus One via Stakewise V3. To be noted that in this case the full amount (and not only multiple of 32 ETH) can be staked at the same time.

RATIONALE

Staking has evolved into a vital pillar of the Ethereum ecosystem. Failing to embrace diversified staking practices would result in the DAO diluting its potential and neglecting its contribution to overall network security and decentralisation. The importance of diversifying Ethereum staking providers cannot be overstated, as it serves to mitigate risks associated with staking. Relying solely on a limited set of staking providers exposes one to potential economic penalties, operational disruptions or regulatory crackdowns.

To illustrate, consider the scenario where you rely on a solitary staking provider utilising a hosted service that receives a directive to cease its services to crypto companies. Such an event would lead to severe penalties for both Nexus Mutual and the network. It is imperative to thoroughly assess and evaluate these types of risks, implementing specific mitigation measures programmatically to ensure the ongoing stability of treasury management.

By adopting a diversified approach to staking providers, Nexus Mutual can proactively safeguard against contingencies, thereby fortifying the continuity of its Capital Pool in the long run.

Regarding infrastructure, this proposal aims to establish direct connectivity with the staking provider via the existing Enzyme vault while leveraging the audited smart contract integrations of Stakewise V3.

Another key aspect of this proposal is the utilisation of the Proof of Reserve Chainlink Oracle, a custom development effort that our team carried out for Nexus Mutual in 2022, which allows Nexus Mutual smart contracts to retrieve the exact value of the investment in real time.

PROPOSAL SPECIFICATIONS

The proposed approach is to proceed with the remaining WETH balance in the vault which currently sits at 6,585.02 WETH. Note, usually ETH is staked in multiple of 32, however because StakeWise is a pooled staking solution, this enables staking in any size and will allow Nexus to earn rewards on all of its capital from day 1.

TECHNICAL REQUIREMENTS

In terms of engineering efforts, the most efficient path to achieving the stated goal for Nexus Mutual is through the integrated and audited Enzyme’s adapter with Stakewise V3. The flow of funds to go from idle WETH in the Enzyme vault (as-is) to being staked via Chrous (to-be) is rather simple: thanks to the native smart contract adapter Enzyme<>Stakewise v3, with one approved transaction from the Enzyme UI, the capital is deposited into the selected Stakewise vault and sent directly to the Beacon Chain via Chorus One. Upon validator withdrawals funds flow back into the Stakewise Vault ready to be claimed by the Nexus Vault contracts. The smart contracts involved in the process are Enzyme, Stakewise v3. This integration will grant Nexus Mutual a permissionless approach to engage directly with the node operator Chorus One. Importantly, the involvement of the Mutual’s Engineering Team is not anticipated, ensuring their undivided focus on current priorities at hand.

Source: https://app.enzyme.finance/

IN DEPTH: STAKEWISE V3

Some key insights about the proposed smart contract connector Stakewise v3.

StakeWise was the first non-custodial staking solution to launch on Ethereum in early 2021. The staking pool accepted any amount of ETH and used StakeWise DAO approved commercial operators to run the validators, removing all economic and technical barriers to entry for staking. As a liquid staking solution, all stakers received sETH2 to represent their staked capital and allow the use of staked capital in DeFi. Staking rewards accrued in a separate receipt token, rETH2, forming the dual token model seen in StakeWise V1 and V2.

StakeWise V3 went live in 2023, white labelling the protocol’s smart contract infrastructure and introducing a new primary LST, osETH. Using StakeWise V3, any entity can launch their own staking pool (known as a Vault) to offer trustless, non-custodial, and pooled ETH staking. Node operators are still required to stake ETH for these pools, but the smart contracts fully automate the rest of the staking processes, including the spinning up and winding down of validators, and the distribution of the staking fees to the pool’s node operators.

The StakeWise smart contracts are fast becoming the foundational staking infrastructure for any entity that is looking to offer pooled and/or liquid staking. Many leading commercial operators, like Chorus One, have embedded the StakeWise infrastructure as part of their core product offering, enabling wallets, exchanges and custodians to leverage the solution for their own staking offerings. Each staking pool is fully isolated and unique, isolating all the risks and rewards of staking to the validators running in each pool.

More information about the StakeWise protocol can be found here.

IN DEPTH: CHORUS ONE

Some key insights about the proposed Node Operator

Name: Chorus One

Pool: Chorus One Opus Pool - MEV Max

Software Client:

- Consensus: Teku & Lighthouse

- Execution: Geth, Besu & Nethermind

Geographical exposure: Chorus One operates globally, with enterprise grade, redundant infrastructure diversified across geographic regions, physical data centres and multiple providers. This geographic and datacenter diversity helps to maintain decentralised and robust infrastructure support for their staking services while minimising risks pertaining to any specific jurisdictions such as having operations ceased due to adversarial regulatory enforcement. Chorus One’s engineers are also geographically distributed across the globe, ensuring 24/7 monitoring and standby support via a follow-the-sun approach

Service Fees: Chorus One has agreed to run nodes for Nexus Mutual at a cost of 5% of the staking rewards. Note, StakeWise DAO does not charge a fee unless Nexus Mutual decides to mint its liquid staking token, osETH, to start deploying staked capital into DeFi. Thus, Nexus Mutual would pay a total of 5% fees for this capital deployment. Comparing this to the fees Nexus Mutual pays for staking with Lido (10% fee) and Rocket Pool (~15% fee), it showcases the benefits of a more bespoke staking configuration.

Rewards: Chorus has also shown a strong performance since joining the StakeWise protocol, with an average of 3.67% returns over the last 6 months (ref), compared to the current staking rates of 3.2% for Lido and 2.86% for Rocket Pool.

Tech: Chorus One is deep into MEV research and has its own proprietary MEV relay called Adagio, an MEV-Boost client designed to enhance MEV and consistently outperforms the market. Combined with the low fees charged by Chorus, their ISO 27001 compliance, and doublesigning & slashing protections, the overall package is a fantastic deal for the Nexus Mutual DAO.

FEES & ONGOING EXPENSES

As clearly outlined in this recent update on the Avantgarde side the fees associated with the vaut are as follows:

- Maintaining an aggregate fee of 15bps on all Assets Under Technology

- Charging a minimum fee of $5k/ month, evaluated at the end of each Quarter at the prevailing ETH/USD rate and settled - if necessary - annually.

- Ethereum gas fees to be absorbed by the vault.

- Enzyme bearing the contract with Chainlink which was previously priced at $2k/month but has now been successfully reduced to $1k/month.

The services and infrastructure that will be provided by Enzyme (or its subcontractors) are as follows:

- Access to Enzyme infrastructure “as is” (protocol and application)

- Execution: farming and compounding of rewards.

- Working closely with Chainlink to make improvements to the vault oracle (in particular, it does not currently track unclaimed ETH rewards)

- Customer support

EXPECTED REWARDS

Expected Annual Rewards

Source: Stake Ethereum | Chorus One — Opus Pool

Validator rewards are automatically harvested every 12 hours and flow back into the Vault smart contract. Whenever a new set of 32 ETH is accrued in the Vault, a new validator will register, this automatically compounding rewards. All this automation is provided by the StakeWise solution.

APY% Fluctuations last 12 months

Source: StakeWise | Vault

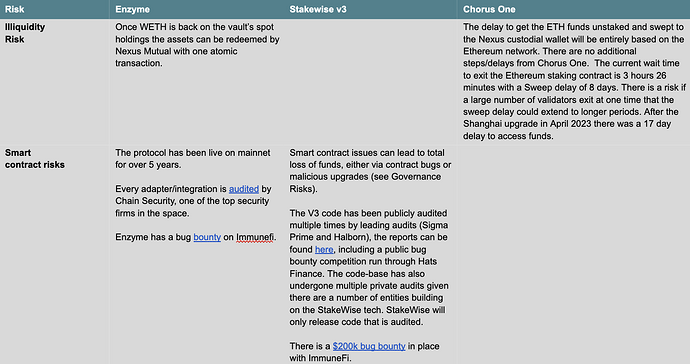

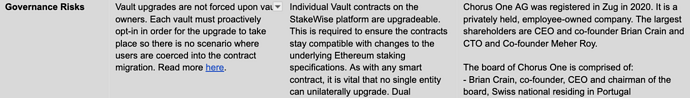

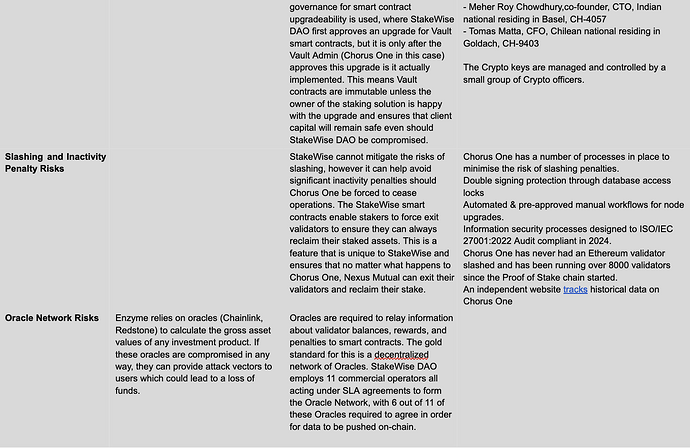

RISKS

A specific elaboration of the template provided, here are some additional details around the specific risks of this particular investment:

Based on the list of risks laid out in the investment philosophy, and the fact that the capital allocated on the Enzyme vault is less than 10% of the capital pool, we believe this strategy qualifies for the lower risk category.

CLOSING REMARK

In conclusion, this proposal outlines a strategic move for Nexus Mutual to harness the benefits of Stakewise V3 and Enzyme in its treasury management. By adopting a more diversified approach to ETH native staking, Nexus Mutual stands to benefit by enhancing the security, stability, and yield potential of the Mutual’s assets. We appreciate your consideration and look forward to further strengthening Nexus Mutual’s financial position through this innovative initiative.